Funding Database Walkthrough: Northern Ireland Business Grants and Funding

Category: Blog, Business Advice, Northern Ireland

Tags: business startups, free money, Grants

As a small business owner or startup entrepreneur in Northern Ireland, it’s important to have capital to start your business, to operate your business and to expand your business. Without the proper funding, your business may soon come to a realization that it can’t start, or grow and you just might have to close your doors. So here is a way to find funding for your business in Northern Ireland in a walkthrough of our Funding Database which you can access as a member of UKStartups.org

Before we begin with the walk though, keep in mind that our Funding Database contains over 1,500 funding sources which come in the form of government grants, government loans, tax breaks as well as from private investors.

While funding exists and is available for all UK regions, the funding programmes and amounts vary from industry to industry and from funding need to funding need. Certain factors that are considered also include the time of the year you apply, your funding needs, your credit score, your business plan, and the application forms.

If you are a member of UK Startups, you already have access to the Funding Database. Simply log in, start your search and apply to the government funding programmes and private investors that are right for your small business.

If you’re not a member, the fee to get access to the platform and all of the tools, resources and services (learn more about them here), you can get your access right now, as it’s instant.

Access Northern Ireland Business Grants and Funding

If you’re not in Northern Ireland and you want to find funding for your small business and to see other locations, go here.

Okay, as a Small Business (starting up or existing), in Northern Ireland you have a number of options to find government funding or private investors.

Taking a quick look at the Funding Database available via UK Startups, the preliminary search shows 345 government grant programmes, 192 government loan programmes, 862 private investor programmes and 289 other funding programmes that are not considered grants, loans or private funding.

What does this mean for you as a small business in Northern Ireland?

Well, for the start, it’s good news.

You probably shouldn’t jump the gun and thin that there are 1,500 funding programmes and investors that are going to give you money, but you should be happy to know that funding exists, and out of the 1,500 funding programmes and investors, surely there may be a few right for your business and your funding needs.

Starting Your Funding Search

Starting your funding search for your business in Northern Ireland can be confusing. Where do you start, what do you look for, how do you know if a programme is available or if it’s right for you?

Well, one of the first steps to searching for funding (government or private) is to ensure you have a business plan created.

What does a business plan have to do with it? A lot actually.

A business plan, if well developed will tell you exactly what you need funding for, when you need it and how much you need.

This will prepare you when it comes to searching for funding.

Instead of “just searching”, you will now know that you need to be searching for money to help you hire staff, train your employees, to pay for advertising, to help you purchase some tools, or equipment, to improve your cash flow. This gives you a focus point which will help you narrow down your search.

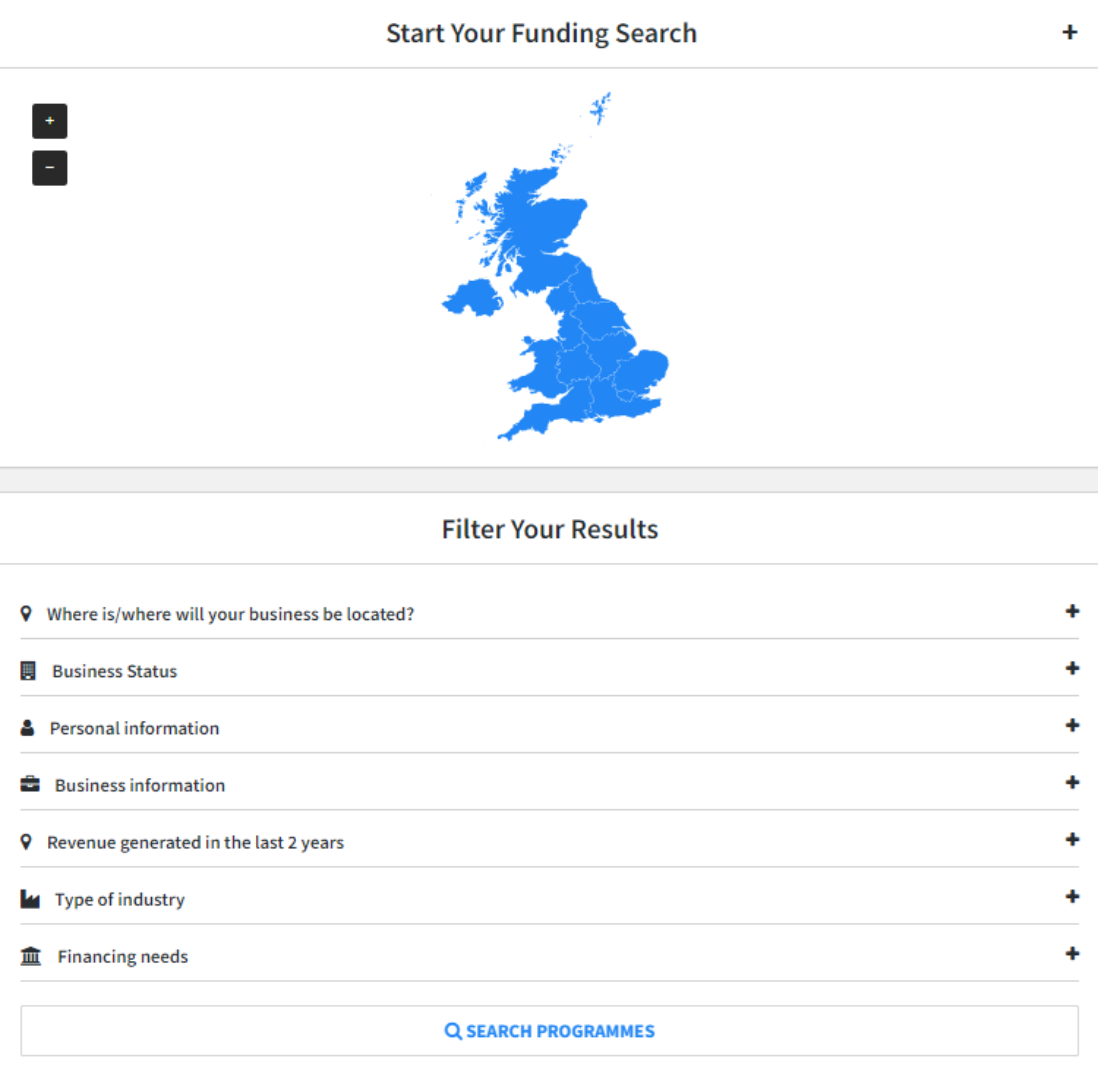

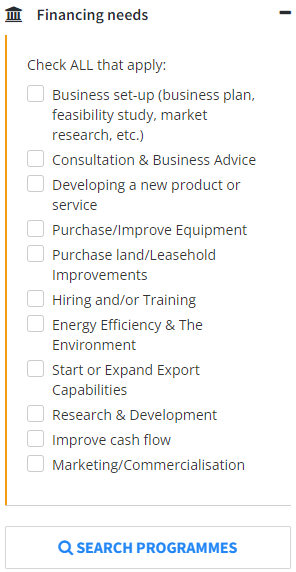

In our Funding Database we ask our members to search for funding programmes based on a few fields (or via keyword search).

The key fields are very important as they do help narrow down the funding programmes and investors from over 1,500 to the ones that are right for your business.

The critical fields that will help you narrow down your funding search include:

– Your Region (in this case you would select Northern Ireland)

– Industry Type

– Funding Needs (what you need funding for)

There are additional selections as shown in the screenshot above that will help add, or remove additional options.

Upon completion, click “Search programmes” to start seeing the programmes and investors which fit those filters.

Knowing How To Search For Funding

By having access to the Funding Database, you are one step closer to getting funded. It’s simple, instead of spending weeks trying to find out information on which programmes are available, we’ve taken the guess work out of it, and not to mention the weeks you would spend trying to find it all.

But that being said, you still have to know how to search for funding programmes or private investors in order to find them.

So here is a tip on how to search for funding properly!

Your Location:

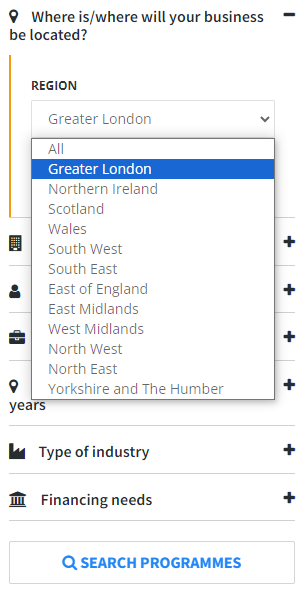

As a small business owner looking for funding for your business in Northern Ireland your first instinct is to say “let me look for funding close to home”, in this case you would jump on the band wagon like everyone else and click “Northern Ireland”.

Right? Who wouldn’t, it makes a lot of sense, doesn’t it?

So here is the tip when you are trying to find funding for your business in Northern Ireland!

Nobody said that you have to use the Region drop-down, or that you have to look for funding only in the Region of Northern Ireland. While it may be your first instinct to do that, there may be other programmes that are federal that may provide funding (or private investors who are outside of that Region).

In fact, there are hundreds of funding programmes that fund businesses across the UK and often don’t base it on a location but the industry or the funding need.

When searching for funding for your small business in Northern Ireland, try both ways. Search with the Region of Northern Ireland selected, and try without (but be sure to select at least one option in industry or funding need) to display some results.

Your Industry:

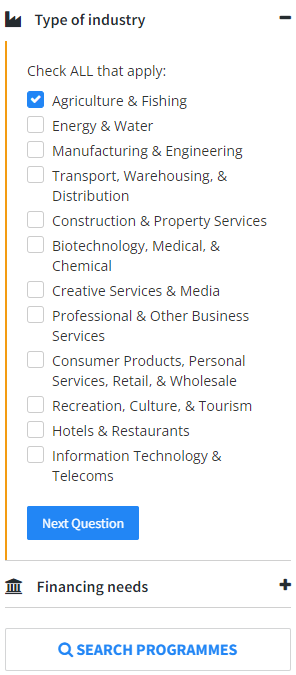

Your industry is very important when searching for funding.

Since a lot of private investors and government funding agencies determine which businesses to fund and which ones to avoid based on the industry they are in, this is a critical component to include when searching for funds in Northern Ireland.

Every single business fits into some sort of industry. And most of them are listed above in the drop down found inside of the Funding Database.

Some businesses can fit into multiple industries and this is the perfect way to search more then one industry at the same time.

When searching for funding for your small business in Northern Ireland be sure to break down the industry and figure out if you actually fit into more then one. Doing so will help you unlock certain programmes or investors which may be of interest to you.

If you wish to skip over the “industry” drop down and just want to see which programmes/investors are available to provide you funding for your business in Northern Ireland you can do that as well, and leave the drop-down unchecked. However if you do this, keep in mind that you may be shown programmes and investors that may not be relevant to your industry and you may have to go through them all to find the right ones for your business.

Your Funding Needs:

Many small business funding programmes and private investors provide money to businesses based on their needs. As mentioned, certain things may be covered and some may not, however the general needs that are more likely to be covered when applying for funding include:

Many small business funding programmes and private investors provide money to businesses based on their needs. As mentioned, certain things may be covered and some may not, however the general needs that are more likely to be covered when applying for funding include:

- Money to hire and train staff

- To help pay for tools and equipment or to get supplies

- Money to help you import and export

- To pay for marketing and advertising costs

- Money to help you conduct R&D or to develop your business

- Funds to help you purchase a business

If you don’t see what you need in the drop down it does not mean it is not covered or that you can’t get funding for it, but it simply means it’s not one of the top reasons.

When searching for funding, break down your funding needs and know what you need funding for. Your business plan will tell you this!

A lot of people when searching for funding simply mess up in this section (and in the application section) because they don’t break down their funding needs, instead they summarise them.

As a small business in Northern Ireland if you’re looking to start up or to expand and you need let’s say £150,000 total funding; when you write your business plan it’s very important to break down your funding needs to show how you exactly came to that conclusion.

Did you need to hire staff? If yes, how much of the £150,000 total is needed for that?

Did you need to pay for some marketing? How much?

Did you need to buy some tools and equipment? How much does it cost?

Doing this, you will have a break down of your funding needs and it will help you when you start your funding search.

Keep in mind that there isn’t one programme or one investor that will give you all of your money. Since certain programmes fund certain things, it’s critical to break it down so you can apply to multiple.

Applying To Multiple Sources Of Funding

To go further into detail on this, applying to one programme or just one investors just because they seem to be “perfect”, is a big mistake.

You’ve surely heard the saying “don’t put all of your eggs in one basket”, well, the saying goes true for your funding search as well.

If you’re in need of funding you probably don’t want to waste time. When you apply for funding, it can take some time before you hear back (approved or not), and some more time before you can actually get the funds in hand. So you want to make sure you’ve timed it all right, so your business does not suffer.

So when you search for funding for your small business in Northern Ireland, it’s important to break down your funding needs and be able to apply to multiple programmes and to multiple private investors.

As mentioned previously, if your intentions are to get let’s say £150,000 in total funding – don’t apply to one programme and hope that they come back and say yes. Instead, break down what you need funding for, break down the amounts needed for each of those funding needs and apply to programmes that you appear to be eligible for.

The more programmes and more investors you apply to, the greater your chances are of being funded.

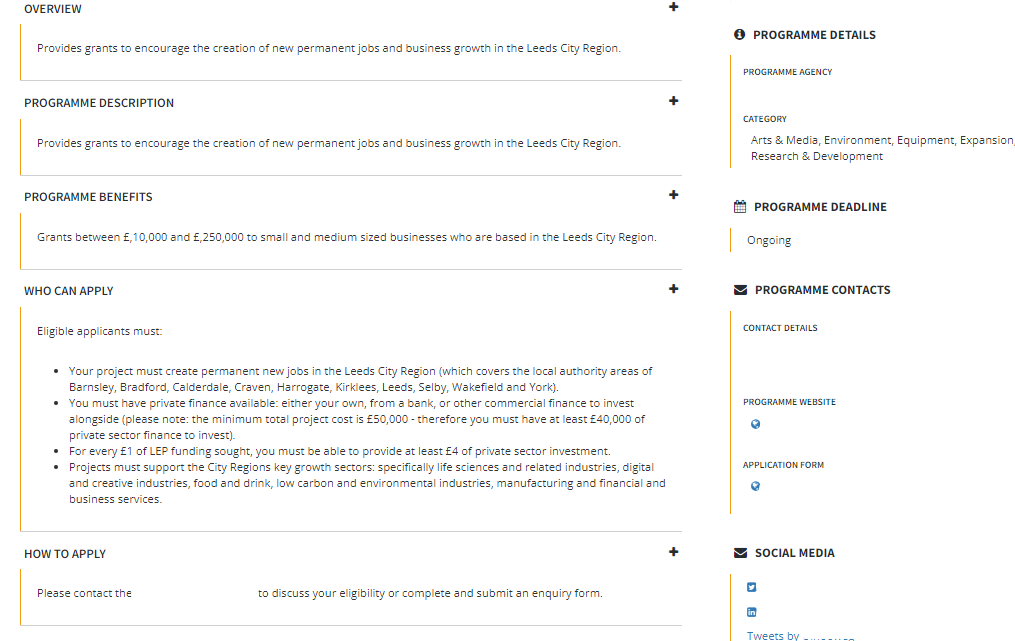

Just so that you have an idea of what a typical programme or private investor looks like in our Funding Database; see the screenshot above. (This is a programme for Leeds City Region, don’t mind that as it’s just an example)

The information that is blurred out is the programme name and ministry/agency that provides the funding – only available to our members to view and a direct link to apply.

The other information that is provided includes the funding overview which tells you (the small business owner), how much money is available to apply to.

This does not mean the total that the funding agency or private investor offers but what the maximum is that you as a small business owner can obtain from this specific programme if successful.

Keep in mind that if you meet the requirements for a programme like this, it doesn’t mean that you should be applying for the maximum of £35,000, but instead apply for what you need (as long as it’s not over the maximum), otherwise, you will get denied.

Other available information includes the industry the funds are available for, the programme details, the qualification criteria, what the funds are for (what they can be used for), the benefits to the government or to the economy or to your business and the location the funds are available for.

You will also be able to see the deadline (if present). This will tell you if you can apply or if you are too late. The deadline is often on-going as programmes often just replenish the funds and continue, but there are certain programmes that end so be sure to apply before the deadline, and don’t wait last minute.

Final Word

Finding funding for your business in Northern Ireland is not impossible. You do have to take some time to review your funding needs, come up with a business plan and start your search.

Be sure that your funding search is done properly, step by step and that you take the time to consider all options.

If you need funding for your business, don’t focus on one type of funding programme (just a grant or just a loan or just a private investor), but keep your mind open and get the money you need to help you start up, to grow and to expand your business.

If you are not a member of UKStartups and you don’t have access to the Funding Database the the rest of our platform and services, now is the time to take action and register.

Registration takes 30 second and you can do it right here. So what are you waiting for? You want funding for your small business in Northern Ireland or what?