How much funding does your business need?

A lack of funding is one of the most common reasons new business' don't make it past the development stage. Any business idea, no matter how great, doesn't stand a chance without the funding needed to get it off the ground. Don't put your entrepreneurial dreams aside because you lack the funds needed to get it started. Small business funding is available for UK small businesses; in the form of grants, loans, tax credits and private investments. Find out exactly how much money is available in your region and industry and take advantage of our Ask an Expert program where we help find funding schemes for you in our personalized funding report and also review your funding applications before you send them out!

STEP 1: LEARN ABOUT THE TYPES OF FUNDING

From renewable grants and government guaranteed loans, to angel investment and wage subsidies; each type of funding has with its own qualification criteria and advantages for the business. Familiarizing yourself with various types of government programmes and private investments available may significantly increase your chances of getting funded.

STEP 3: BROWSE FUNDING SOURCES

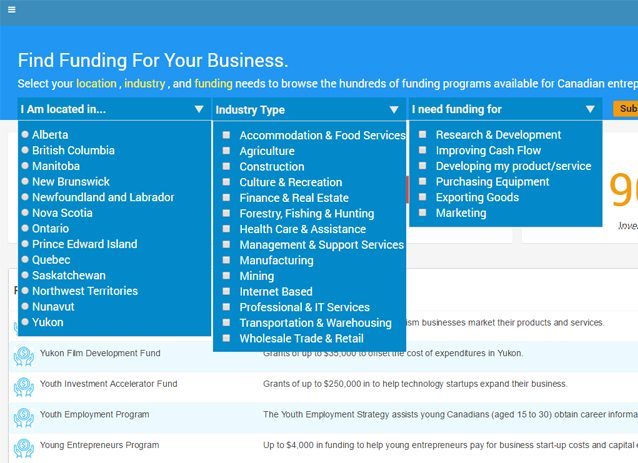

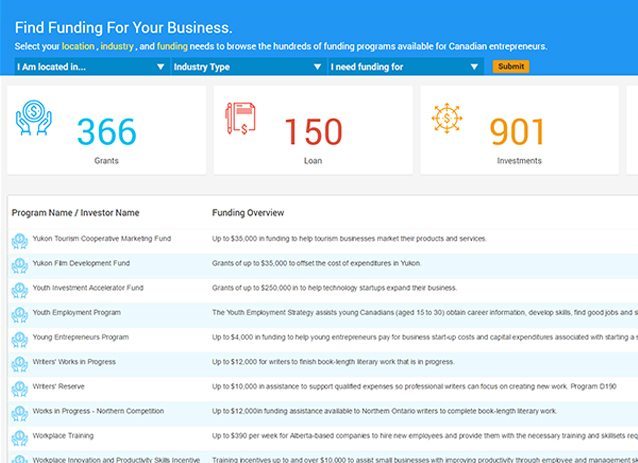

Funding is allocated to small businesses through hundreds of government agencies, departments, and private firms; which makes it difficult for entrepreneurs to quickly locate the programs for which they qualify. Our funding database is a searchable listing (find programmes in your region, industry and for your particular needs) of over 1,500 programmes for UK small business.

STEP 2: ASSESS YOUR FUNDING NEEDS

You know you need money, but what for? Funding programmes and investors want to know that their money is going to good use, so they categorize the funds by purpose. Whether you need money to cover startup costs, hire staff, purchase equipment, for marketing or to develop your product; funding is available for UK entrepreneurs.

STEP 4: APPLY FOR FUNDING

Having access to over 1,500 funding sources, you can start applying for funding today. Many programmes require a business plan be submitted along with the application. The Startup Portal contains all of the tools and resources you'll need to successfully apply for business funding; including a Business Plan Builder and Investor PitchDeck to ensure your make a great first impression.

Browse 1700+ Funding Programmes for UK Entrepreneurs

Find government grants, loans and private investors available for small businesses in your area.

Small Business Funding Database

As a member of UKStartups.org you instantly get access to the small business funding database. Our database contains over 1,500 funding sources of government grants, loans and private funding to help small business startups succeed.

Along with the Funding Database, as a member you will also have instant access to the Business Plan Builder Tool and the Investor PitchDeck. All tools are provided to help you fund your business.

The process is simple. Figure out how much you need, what you need it for, research the available funding sources and apply.

How can funding help your business?

When starting a small business, many expenses will arise before you're even close to making your first dollar. Funding can be especially helpful when it comes time to buy much needed equipment, to renovate your space and when you're ready to start advertising.

Obtaining funding for your small business, regardless of whether it comes from a bank, a private investor, or a government programmee can mean the difference between your business' failure and success. Having access to funding in the early stages of business' can open the doors to many opportunities to better develop your business and increase its reach. Increasing your chances of success, right from Day 1.

UK Government Funding

As a UK small business owner you are in luck. The British government allocates billions of pounds each year in an attempt to support small businesses across the country. This government support comes from local, regional and national governments and typically in the form of a government grant, a low interest or no interest loan, a tax credit or financial contributions.

Our Small Business Funding Database currently contains [total-grant-programs] grant programmes, [total-loan-programs] loan programmes, [total-other-funding] assistance programmes to select from. Funding varies in amounts from £1,000 to over £5 million in potential funding to small business owners across the UK.

The government also funds small business startups in all regions, in all industries and different government agencies are there to fund the various funding needs you may have.

Private Funding For Businesses

When you turn to private funding to obtain capital for your business forward, you're taking a giant step toward your business' success.

Our Small Business Funding Database provides you with access to [total-investor-programs] private funding sources. These sources include angel investors, venture capitalists and banks. Getting your small business funded is your primary concern, so we try to provide you with a wide variety of funding sources to dramatically improve your opportunities for success.

Just like government funding, private funding sources fund businesses in pretty much all industries, all across the UK and for various purposes. Sometimes, private funding can prove to be a better option that offers many advantages that can't be accessed when applying for funding through the government. Take some time to familiarize yourself with private funding and see what it can do for your small business goals.